AmBank Credit Card - 5X BonusLink Points on Fridays & Weekends

AmBank Credit Card - 5X BonusLink Points on Fridays & Weekends

Extra reason to love Fridays & Weekends with your AmBank M-Card and MBF Cards Credit Card

Eligible Cardmembers who participate in this Programme will stand to receive during the Programme Period:

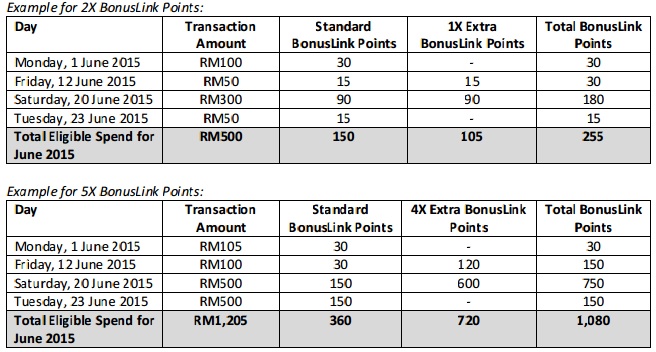

a) 2X BonusLink Points on eligible retail transactions performed on Fridays & weekends (“Eligible Spend” defined below), if their monthly cumulative retail transaction (“Qualifying Spend” defined in Clause 5) is between RM500 and RM 999.

b) 5X BonusLink Points on eligible retail transactions performed on Fridays & weekends (“Eligible Spend” defined below), if their monthly cumulative retail transaction (“Qualifying Spend” defined in Clause 5) is equal to or greater than RM1,000.

Terms and Conditions

- This programme is valid from 1 June 2015 to 31 December 2016 and is open to all Ambank M-Card and MBF Cards Principle & Supplementary Cardmembers (Excluding Corporate, Commercial and Insurance Cardmembers)

- A maximum of20 million BonusLink Points to be given out monthly on a first-come, first-served basis

- Cardmembers (Principal & Supplementary combined) are entitled to a maximum of 30,000 BonusLink Points per month, which will be credited to the BonusLink Principal Cardholder in a household account.

- This Programme is applicable to Eligible Cardmembers who hold a valid Card and use their Card to perform any retail transaction. Retail transaction shall mean purchase of transactions for goods and services incurred for personal consumption and excludes transactions incurred for business purposes, for betting or gaming transactions.

- Qualifying spend includes all local and overseas retail transactions which will be taken into consideration in arriving at the cumulative monthly retail transaction EXCEPT for

- cash advance/quasi-cash and all on-going instalment payments including Balance Transfer/ Quickcash/ AmFlexi-Pay

- standing instructions / auto bill payments

- insurance / takaful transactions with MCC codes 5960 & 6300

- transactions made to government bodies/ education institutions

- all direct selling / trade financing / transactions under special corporate arrangement where rebate is applicable/ Corporate Bill Payment / Corporate GIRO transactions

- qualifying retail transactions which are subsequently cancelled or refunded, disputed, unauthorized or fraudulent transactions; and

- all fees, charges or penalties whether imposed by the Bank or otherwise

- The 2X or 5X BonusLink Points will be awarded to Eligible Cardmembers for their Eligible Spend which is defined as all local and overseas retail transactions performed on Friday & weekends EXCEPT for transactions listed in Clause 5 and transactions carried out at petrol stations. For retail transactions which are not within the Eligible Spend for this programme, the standard BonusLink Points awarded remains status quo unless otherwise notified. For overseas retail transactions, the maximum BonusLink Points received will be 2X/5X respectively depending on card type.

- All Eligible Spend must be successfully posted to the Eligible Cardmember’s Card account to be eligible for the 2X or 5X BonusLink Points. The Bank will allow five (5) calendar days for the eligible spend made to be posted into the Eligible Cardmember’s Card account. The Bank is not responsible in any manner whatsoever for any late posting to Eligible Cardmember’s account by merchants and/or third party.

- All Eligible Spend made by the Principal Cardmember and their Supplementary Cardmember(s) will be consolidated and will not be viewed individually. Eligible Spend by Supplementary Cardmembers will also be entitled to the 2X or 5X BonusLink Points and any BonusLink Points will be awarded to their respective Principal Cardmembers account

- Click here for Full Terms and Conditions

Promotion Period : 01-Jun-2015 till 31-Dec-2016

Posted on 11-Oct-2015

Singapore Credit Card Promotions

Singapore Credit Card Promotions Malaysia Credit Card Promotions

Malaysia Credit Card Promotions